Life Insurance in and around Fort Myers

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Do you know what funerals cost these days? Most people aren't aware that the typical cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the ones you leave behind cannot meet that need, they may fall into debt as a result of your passing. With a life insurance policy from State Farm, your family can be okay, even without your income. Whether it maintains a current standard of living, keeps paying for your home or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Wondering If You're Too Young For Life Insurance?

You’ll get that and more with State Farm life insurance. State Farm has terrific policy choices to keep your loved ones safe with a policy that’s adjusted to fit your specific needs. Fortunately you won’t have to figure that out by yourself. With deep commitment and excellent customer service, State Farm Agent Michele Losapio walks you through every step to set you up with a plan that covers your loved ones and everything you’ve planned for them.

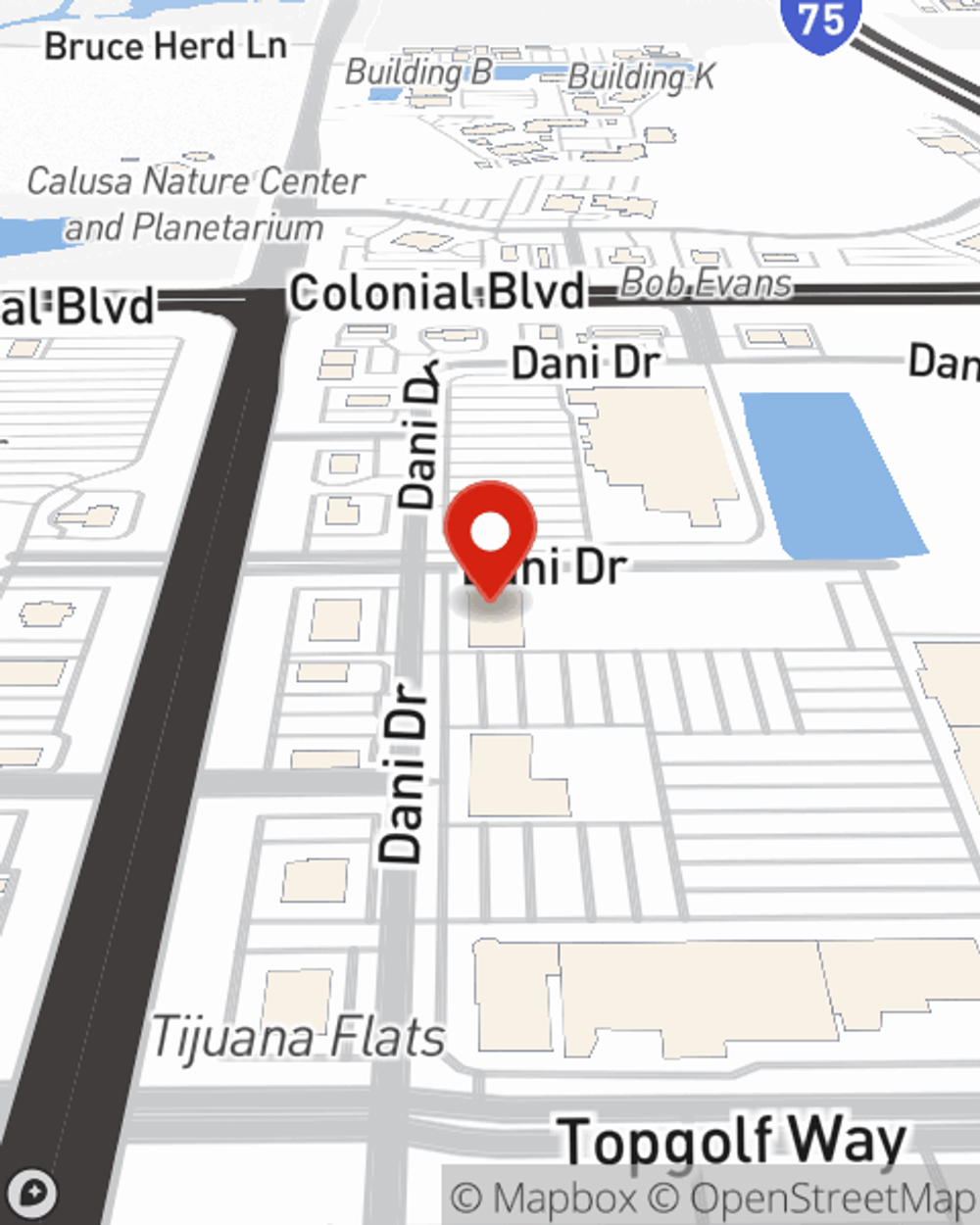

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to experience what the State Farm brand can do for you? Visit State Farm Agent Michele Losapio today.

Have More Questions About Life Insurance?

Call Michele at (239) 332-4999 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Michele Losapio

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.